Celebrating Native CDFIs Advancing Financial Recovery of Local Economies

Oweesta Corporation (Oweesta) and NDN Collective continue to stand in solidarity with Indigenous communities who remain uniquely affected by the COVID-19 pandemic. Together as an Indigenous-led partnership, we are awarding a combined $1,250,000 in grants to 25 Native CDFIs through our COVID-19 Grant Program. These Native CDFIs will further their roles as the economic engines for financial sovereignty in Indian Country through the COVID-19 Grant Program.

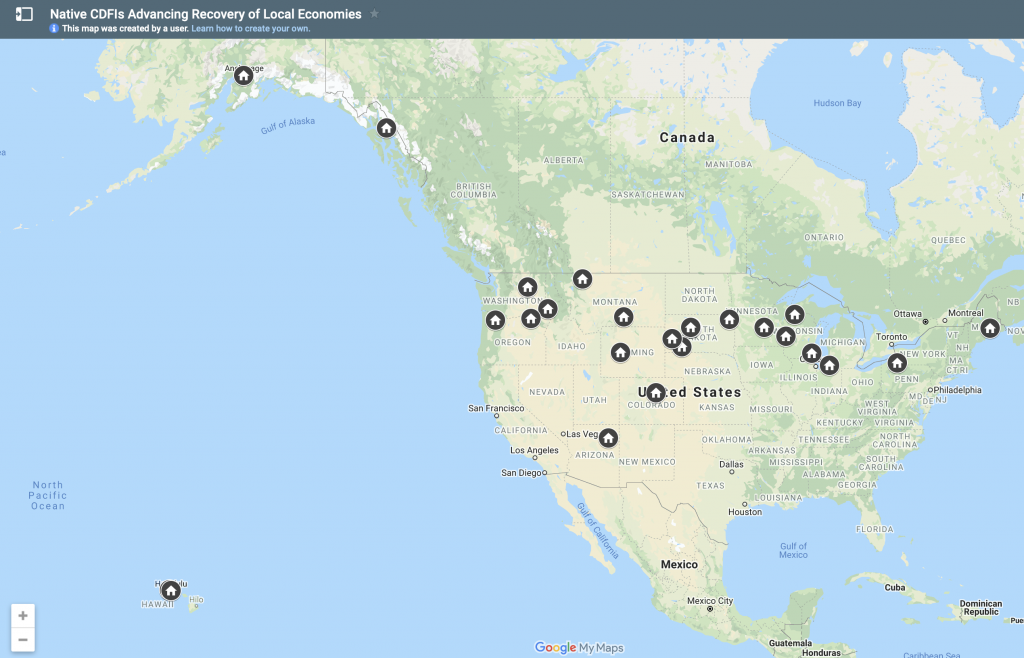

These organizations have been integral in the sustaining of Indigenous businesses across the United States, from Alaska to Hawaii to Maine. When stay-at-home orders and closures were first issued, Native CDFIs quickly adapted to the emerging needs in their communities; they provided emergency relief capital, supported local businesses adapt to unforeseen supply chain issues, and offered refinancing terms for new and outstanding loans. Knowing that sustaining is not enough, they are also pivoting their business operations and policies to help their communities flourish for a new and better normal.

What’s a Native cdfi, and what are they doing during the COVID-19 Pandemic?

Learn more in the video below:

NACDC Financial Services based in Montana is one such CDFI who has creatively worked with their 600+ clients to ensure no business has had to close. Tourism is a main source of income for several businesses on the Blackfeet Reservation, one of the seven reservations NACDCFS services. Following the closure of the East Glacier Park, many businesses, also clients of NACDCFS, experienced significant financial loss. NACDCFS worked with their clients individually to determine repayment plans and terms and connected them with additional capital resources. They will soon move their technical assistance and trainings virtually in order to help small businesses, agriculture, and homeownership clients succeed.

Hopi Credit in Arizona, similarly, saw many self-employed Tribal members, like artists and food vendors, financially suffer from the cancellation of the Santa Fe Indian market, powwows, and other events, and realized the products and services they traditionally offered weren’t enough for the community. They offered a small business emergency loan and worked with new and existing clients to defer loans payments. Hopi Credit will use the funds to hire more staff to begin realizing their long-term vision of developing much-needed economic infrastructure on the reservation in an effort to keep money circulating within the community.

Overall, the grantees will be essential to the financial recovery of local economies. Oweesta and NDN Collective’s joint commitment to long-term community resilience and sustainability will be furthered by the work and dedication of Native CDFIs.

Use this interactive map to learn more about our grantees.

Here is a complete list of all 25 CDFI Grantees

| Cook Inlet Lending Center |

| Council for Native Hawaiian Advancement |

| First American Capital Corporation (FACC) |

| First Nations Community Financial (FNCF) |

| Four Bands Community Fund |

| Four Directions Development Corporation |

| Homestead Community Development Corporation |

| Hopi Credit Association |

| Lakota Funds |

| Mni Sota Fund |

| NACDC Financial Services, Inc |

| Native American Bank |

| Native American Development Corporation |

| Nimiipuu Community Development Fund |

| Nixyáawii Community Financial Services |

| Northwest Native Development Fund |

| Affiliated Tribes of Northwest Indians Economic Development Corporation |

| Seneca Nation of Indians Economic Development Company |

| Sisseton Wahpeton Federal Credit Union |

| Spruce Root, Inc. |

| Akiptan, Inc |

| Wind River Development Fund |

| Wisconsin Native Loan Fund |

| Black Hills Community Loan Fund |

| Chi Ishobak, Inc |

This COVID-19 CDFI Grant Program is part of NDN Collective’s NDN COVID-19 Response Project. Another announcement will be forthcoming on NDN’s final round of COVID-19 Transition & Resilience Grantees.